CARES ACT

VW MITIGTION TRUST

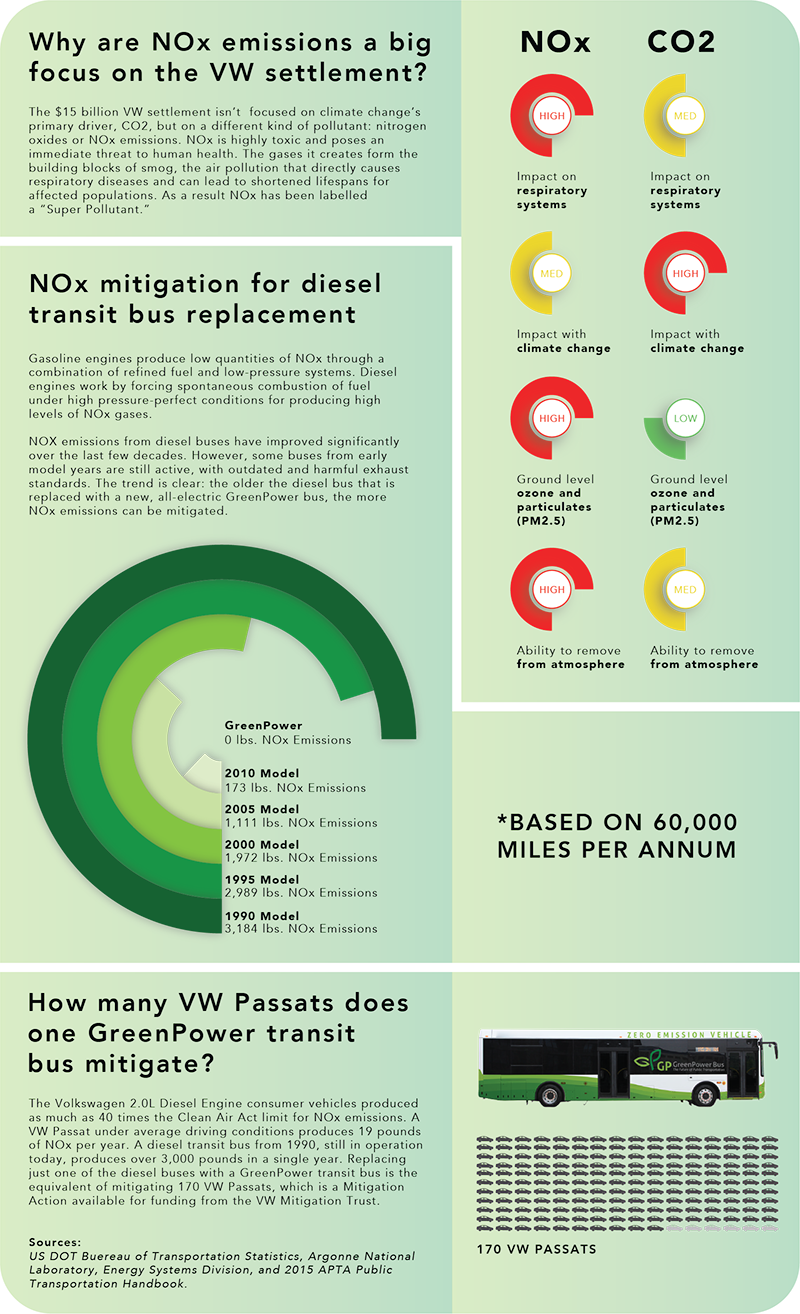

After the Environmental Protection Agency (EPA) issued a notice to Volkswagen Group for fraudulent emissions testing, the German automaker made an initial settlement for affected 2.0L diesel engine vehicles with the United States District Court for $14.7 billion on October 25, 2016. Included in the settlement is a $2.7 billion Environmental Mitigation Trust to fund actions that remediate excess NOx emissions. In a separate decree, the Court determined an additional $225 million would be placed in the Trust for fraudulent 3.0L vehicles, giving the Fund a total of over $2.9 billion.

For non-government entities, the financing from the Volkswagen mitigation trust can be up to 75 per cent of the cost of a new all-electric bus, including the charging infrastructure; while, for government entities, the financing can be up to 100 per cent.

Potential Beneficiaries of the funds include all 50 states, the District of Columbia, Puerto Rico, and federally recognized Native American tribes. Each of these entities must establish Beneficiary status by filing a certification form (Appendix D-3 of the settlement) with the Court via its own lead agency.

In the case of the Native American tribes, each band – acting as its own Beneficiary – must file its first funding request with its application for Beneficiary status.

Once the Court appoints a Trustee, it will select a Trust Effective Date (TED) to begin the process of making funds available. Potential Beneficiaries have 60 days from the TED to apply for status, otherwise they will be considered an Excluded Entity and prohibited from accessing funds.

After applications are submitted, the Trustee has 120 days from the TED to evaluate the submissions and to publish online a complete list of Beneficiaries. After being deemed a Beneficiary, all entities (excluding Tribes) must submit and publish online a Beneficiary Mitigation Plan. Once completed and approved, Beneficiaries may request funds for Eligible Mitigation Actions in accordance with their Plan.

The following table sets out the Initial Allocation of the $2.7 billion from the Amended 2.0L Partial Consent Decree and does not include the additional $225 million from the 3.0L Settlement.

| INITIAL SUBACCOUNTS | INITIAL ALLOCATIONS ($) | INITIAL ALLOCATIONS (%) |

|---|---|---|

| Alabama | $24,084,726.84 | 0.89% |

| Alaska | $7,500,000.00 | 0.28% |

| Arizona | $53,013,433.35 | 1.96% |

| Arkansas | $13,951,016.23 | 0.52% |

| California | $381,280,175.09 | 14.12% |

| Colorado | $61,307,576.05 | 2.27% |

| Connecticut | $51,635,237.63 | 1.91% |

| Delaware | $9,051,682.97 | 0.34% |

| District of Columbia | $7,500,000.00 | 0.28% |

| Florida | $152,379,150.91 | 5.64% |

| Georgia | $58,105,433.35 | 2.15% |

| Hawaii | $7,500,000.00 | 0.28% |

| Idaho | $16,246,892.13 | 0.60% |

| Illinois | $97,701,053.83 | 3.62% |

| Indiana | $38,920,039.77 | 1.44% |

| Iowa | $20,179,540.80 | 0.75% |

| Kansas | $14,791,372.72 | 0.55% |

| Kentucky | $19,048,080.43 | 0.71% |

| Louisiana | $18,009,993.00 | 0.67% |

| Maine | $20,256,436.17 | 0.75% |

| Maryland | $71,045,824.78 | 2.63% |

| Massachusetts | $69,074,007.92 | 2.56% |

| Michigan | $60,329,906.41 | 2.23% |

| Minnesota | $43,638,119.67 | 1.62% |

| Mississippi | $9,249,413.91 | 0.34% |

| Missouri | $39,084,815.55 | 1.45% |

| Montana | $11,600,215.07 | 0.43% |

| Nebraska | $11,528,812.23 | 0.43% |

| Nevada | $22,255,715.66 | 0.82% |

| New Hampshire | $29,544,297.76 | 1.09% |

| New Jersey | $65,328,105.14 | 2.42% |

| New Mexico | $16,900,502.73 | 0.63% |

| New York | $117,402,744.86 | 4.35% |

| North Carolina | $87,177,373.87 | 3.23% |

| North Dakota | $7,500,000.00 | 0.28% |

| Ohio | $71,419,316.56 | 2.65% |

| Oklahoma | $19,086,528.11 | 0.71% |

| Oregon | $68,239,143.96 | 2.53% |

| Pennsylvania | $110,740,310.73 | 4.10% |

| Puerto Rico | $7,500,000.00 | 0.28% |

| Rhode Island | $13,495,136.57 | 0.50% |

| South Carolina | $31,636,950.19 | 1.17% |

| South Dakota | $7,500,000.00 | 0.28% |

| Tennessee | $42,407,793.83 | 1.57% |

| Texas | $191,941,816.23 | 7.11% |

| Tribal Administration Cost Subaccount | $993,057.15 | 0.04% |

| Tribal Allocation Subaccount | $49,652,857.71 | 1.84% |

| Trust Administration Cost Subaccount | $27,000,000.00 | 1.00% |

| Utah | $32,356,471.11 | 1.20% |

| Vermont | $17,801,277.01 | 0.66% |

| Virginia | $87,589,313.32 | 3.24% |

| Washington | $103,957,041.03 | 3.85% |

| West Virginia | $11,506,842.13 | 0.43% |

| Wisconsin | $63,554,019.22 | 2.35% |

| Wyoming | $7,500,000.00 | 0.28% |

The distribution schedule follows the following formats:

A Beneficiary may not request more than one-third of its allocation during the first year after VW makes its initial deposit into the Trust; during the first two years, a Beneficiary may not request more than two-thirds of its allocation.

Funding for federally recognized tribes will go through six cycles beginning September 1 after the TED, each cycle lasting one year and ending the following September 1. During those cycles, the allocation of funds is limited by an allotment specific to that year, such that the Trustee can only grant one-sixth (currently approximately $9 million) of the Tribal Sub-Account within the first year.

Whether state or tribe, the Trustee will distribute funds within 15 days of approving the fund requests for the corresponding Mitigation Action.

There are 10 Eligible Mitigation Actions as listed by the Partial Consent Decree, Appendix D-2, focused on reducing mobile NOx emissions. They include the removal and replacement of freight trucks, freight switchers, ferries/tugs, light-duty ZEV supply equipment; and Class 4-8 school, shuttle, and transit buses.

Eligible buses include pre-2009 engine model year or older. The buses must be scrapped and may be replaced with a new all-electric vehicle.