Vancouver, Canada – February 27, 2020 – GreenPower Motor Company Inc. (TSX-V: GPV) (OTCQX: GPVRF) (“GreenPower” or the “Company”), a leading designer, manufacturer, and distributer of a diverse line of all-electric buses for the transit, shuttle, tourist and school sectors, today announced results for its third quarter ended December 31, 2019.

Quarterly Highlights:

- Sold or leased a record 35 all-electric buses during the period, comprised of 33 EV Stars and two Synapse Type D School buses.

- Reported quarterly revenue of $5 million compared to $1.1 million for the same quarter in the previous year, an increase of 350%.

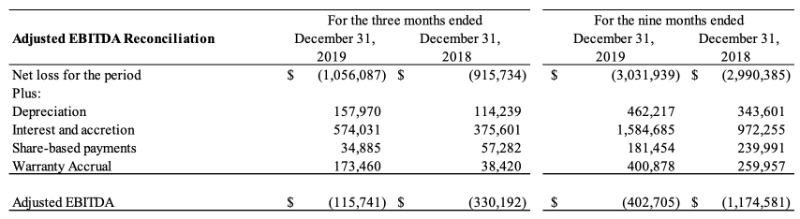

- Reported quarterly Adjusted EBITDA loss of $115,741 compared to an Adjusted EBITDA loss of $330,192 in the previous year.

- Gross profit margin during the quarter was 29.4%, compared to 25.6% in Q2.

- For the nine months ended December 31, 2019 the Company generated revenue of $12.9 million compared to $3.6 million for the nine months ended December 31, 2018, an increase of 258%.

- Delivered 30 EV Stars to Green Commuter, pursuant to an order for 100 EV Stars that was placed earlier in the year.

- Delivered 3 EV Stars to Sacramento Regional Transit being a follow-on order from the 6 EV Stars delivered earlier in the summer.

- The Synapse Type D School bus passed the California Highway Patrol certification and received the 292 card.

- Currently there are 50 EV Stars in production and another 50 in pre-production.

- At December 31, 2019 the Company had received approvals for 85 HVIP voucher requests relating to sales in California, for a total of approximately $9 million reserved from the 2019 allocation, subject to final delivery and approval.

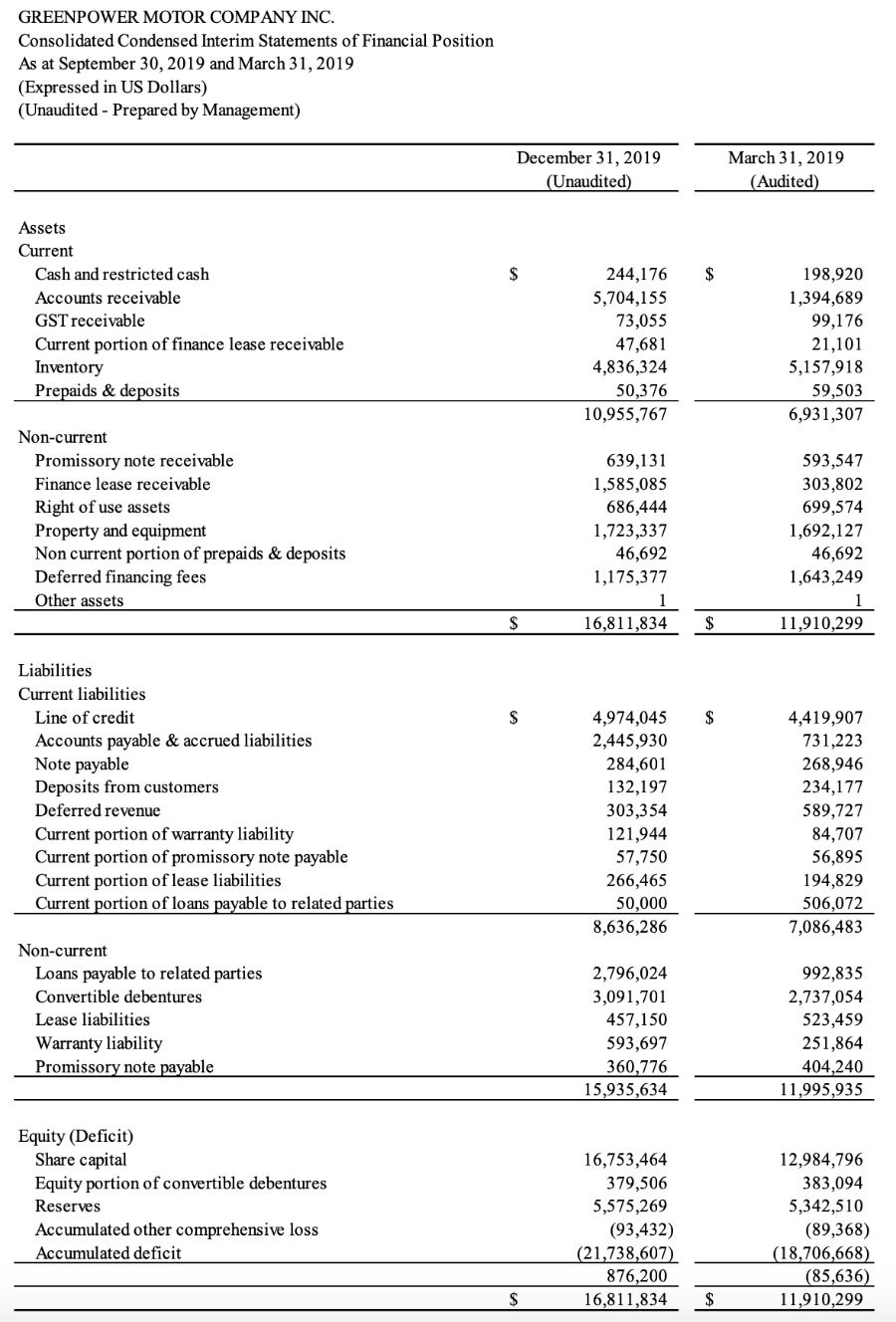

- Finished the quarter with inventory of $4.8 million, including $2.5 million of finished goods and $2.3 million of work in process and accounts receivable of $5.7 million.

“In the last two quarters the Company has delivered 62 all-electric buses which is substantially more than we had delivered up to that point. Given our current strong order book and nation-wide sales reach, we are well-positioned to continue to deliver robust growth going forward,” said Fraser Atkinson, Chairman and CEO of GreenPower Motor Company. “We are pursuing various initiatives to maximize our operating efficiencies, expand margins, and leverage our position in the market to meet increasing demand across North America. In addition, we continue to work towards uplisting to the NASDAQ stock exchange, which, we believe, will be of benefit to our shareholders.”

Results for the Third Quarter Ended December 31, 2019

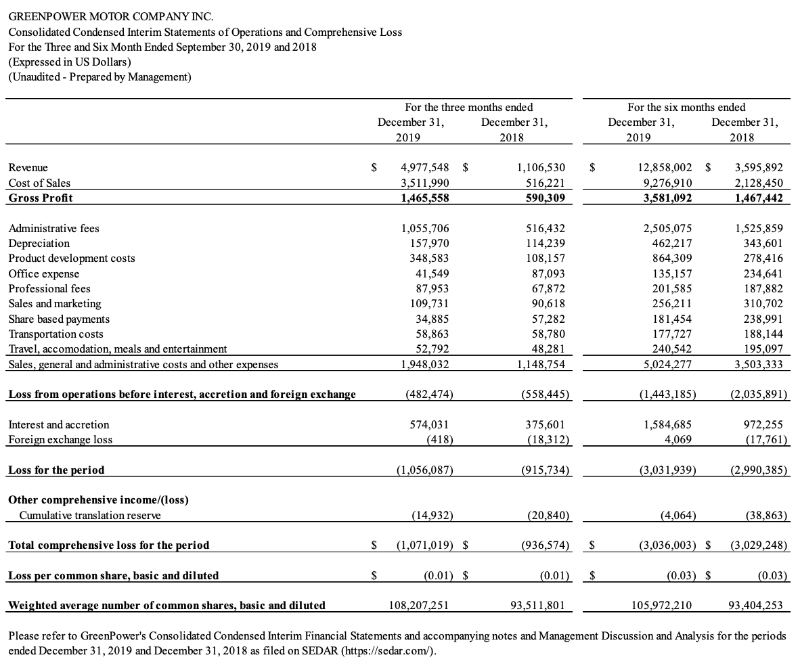

For the three-month period ended December 31, 2019 the Company recorded revenues of $4,977,548 compared to $1,106,530 for the three months ended December 31, 2018 an increase of 350%. Cost of sales for the quarter amounted to $3,511,990 yielding a gross profit of $1,465,558 or 29.4% of revenues compared to a gross profit of $590,309 for the same quarter in the previous year. Operating costs consisted of administrative fees of $1,055,706, transportation costs of $58,863; travel, accommodation, meals and entertainment costs of $52,792, product development costs of $348,583; sales and marketing costs of $109,731; professional fees of $87,953 and office expense of $41,549, as well as non-cash expenses including $34,885 of share-based compensation expense and depreciation of $157,970. Interest and accretion on the line of credit, convertible debentures and promissory notes totalled $574,031, and a foreign exchange gain of $418 resulted in a loss for the period of $1,056,087 or $0.01 per share. Non-cash expenses consisting of depreciation, accretion and accrued interest, share-based compensation, warranty accrual and amortization of deferred financing fees totaled $675,755 in the three-month period.

Results for the Nine Months Ended December 31, 2019

For the nine-month period ended December 31, 2019 the Company recorded revenues of $12,858,002 compared to $3,595,892 for the nine months ended December 31, 2018 an increase of 258%. Cost of sales for the period amounted to $9,276,910 generating a gross profit of $3,581,092 or 27.9% of revenues. Operating costs consisted of administrative fees of $2,505,075, transportation costs of $177,727, travel, accommodation, meals and entertainment costs of $240,542, product development costs of $864,309; sales and marketing costs of $256,211; professional fees of $201,585 and office expense of $135,157 as well as non-cash expenses including $181,454 of share-based compensation expense and depreciation of $462,217. Interest and accretion on the line of credit, convertible debentures and promissory notes totalled $1,584,685, and a foreign exchange loss of $4,069 resulted in a loss for the period of $3,031,939 or $0.03 per share.

Non IFRS Financial Measures

“Adjusted EBITDA” reflects net income before interest, taxes, share-based payments, depreciation and amortization, and warranty accrual. Adjusted EBITDA is a measure used by analysts and investors as an indicator of operating cash flow since it excludes the impact of movements in working capital items, non-cash charges and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the cash generated from the operations of a business. However, Adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by GreenPower may not be comparable to Adjusted EBITDA as calculated and reported by other companies.

Conference Call

A conference call will be held on February 27th, 2020, at 1:30 p.m. PT/4:30 p.m. ET and will be available for replay after complete. This call will contain forward-looking statements and other material information regarding the Company’s financial and operating results. To participate, interested parties should dial 1-877-270-2148 (US); 1-866-605-3852 (Canada); or 1-412-902-6510 (International) and ask to be joined to the GreenPower Motor Company earnings call.

For further information contact

Fraser Atkinson

Chairman and CEO

(604) 220-8048

Michael Sieffert

CFO

(604) 563-4144

Brendan Riley

President

(510) 910-3377

Michael Cole

GreenPower Investor Relations

(949) 444-1341

About GreenPower Motor Company Inc.

GreenPower designs, builds and distributes a full suite of high-floor and low-floor vehicles, including transit buses, school buses, shuttles, a cargo van and a double decker. GreenPower employs a clean-sheet design to manufacture all-electric buses that are purpose built to be battery powered with zero emissions. GreenPower integrates global suppliers for key components, such as Siemens or TM4 for the drive motors, Knorr for the brakes, ZF for the axles and Parker for the dash and control systems. This OEM platform allows GreenPower to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. For further information go to www.greenpowermotor.com.

Forward-Looking Statements

This document contains forward-looking statements relating to, among other things, GreenPower’s business and operations and the environment in which it operates, which are based on GreenPower’s operations, estimates, forecasts, and projections. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Such forward-looking statements include, among other things that the Company is well. positioned to continue to deliver robust growth going forward, that the Company will maximize operating efficiencies, expand margins and leverage its position in the market, that the Company will list its shares on NASDAQ and that such listing will be of great benefit to the Company’s shareholders, that the Company will receive approval for its 118 HVIP voucher-request work $12.3 million. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: the risk that government policies or laws may change and that additional governmental regulations may be implemented regarding the production and sale of electric vehicles; the risk that purchasers may not purchase the Company’s EV products; the risk that there may be additional competitors selling EV products; the risk that the Company will not be able to deliver completed buses on time; the risk that the Company’s clients will not default on their purchase terms; the risk that governmental regulations and taxation will change to adversely affect the Company’s business and financial results; the risk that government grants that reduce the cost of purchasing electric vehicles will be reduced, cancelled, or delayed, including the HVIP voucher requests relating to sales in California; the risk that the Company has a limited number of suppliers; the potential for supply-chain interruption due to factors beyond the Company’s control; the risk that there may be a recall of products; the inherent uncertainties associated with operating as an early-stage company; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and sales activity; general economic conditions in Canada, the United States, China and globally; transportation industry conditions; potential delays or changes in plans with respect to deployment of services or capital expenditures; availability of sufficient financial resources to pay for the development and costs of the Company’s products; competition for, among other things, capital and skilled personnel; changes in economic and market conditions that could lead to reduced spending on green energy initiatives; competition in our target markets; management of future growth and expansion; the development, implementation and execution of the Company’s strategic vision; risk of third-party claims of infringement; legal and/or regulatory risks relating to the Company’s business and strategic acquisitions; protection of proprietary information; the success of the Company’s brand development efforts; risks associated with strategic alliances; reliance on distribution channels; product concentration; the Company’s ability to hire and retain qualified employees and key management personnel. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although the Company believes that any beliefs, plans, expectations, and intentions contained in this news release are reasonable, there can be no assurance that any such beliefs, plans, expectations or intentions will prove to be accurate. Readers should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents the Company files with on the SEDAR, available at www.sedar.com.